Softbank’s founder son makes his biggest bet by telling the future on AI

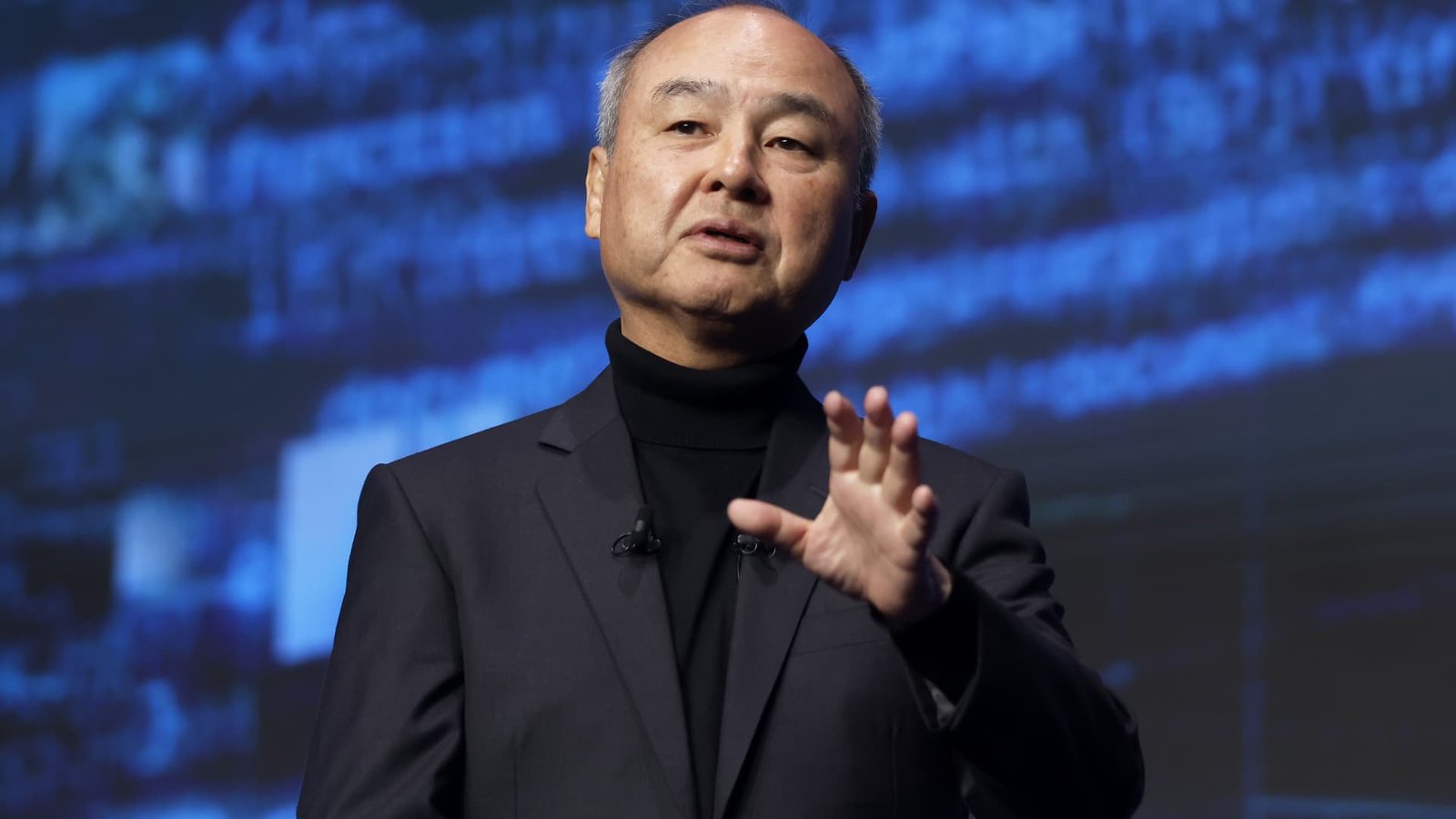

Masayoshi son, Softbank Group President and CEO of the Softbank Group Corporation, speaks at the Softbank World Event in Tokyo, Japan on Wednesday, July 16, 2025.

Kioshi Oat | Bloomberg | Getty

Masayosa’s boy is still making the biggest betting: that his brainchild Softbank Will be the center of revolution run by artificial intelligence.

The boy says that artificial superintendents (ASI) – AI that is 10,000 times smarter than humans – will be here in 10 years. This is a bold call – but probably not surprising. He has done a career in big plays; Significantly, the Chinese e-commerce company had an investment of $ 20 million Alibaba In 2000 who has made billions for Softbank.

Now, billionaire AI companies are expecting to replicate the success of the investment and acquisition of those who will keep Softbank in the middle of the basic technical shift.

Over the past year, the boy has spoken clearly about his vision, but according to the information given by two former U -U -U -Softbank officials, there is a lot before his recent backbone.

“When he sat on me for the first time and sitting on a glass of wine on his porch, I remembered, he began to talk to me about the solitude – the machine is overtaking human intelligence,” Alokbank, former finance chief Alok Sam Sam and president and president, told the CNBC.

Softbank’s big AI plays

For the child, AI looks personal.

“What purpose was Softbank was founded? What purpose was the mosquito child born? It would seem strange, but I think I was born to realize ASI,” the boy said last year.

To explain what an aggressive drive is in the last few years – but especially the last two – it can go some way to put a softbank in the middle of the AI story.

In १ In, Softbank seized chip designer arm At that time in a contract of about $ 22 billion. Today, Hand Is worth more than $ 145 billion. Arm Blueprints create the basis for the design of almost all smartphones in the world, nowadays, looking for a company Place yourself as an important player in AI Infrastructure?? Are part of the arm-based chips Nvida ‘S system that goes to the data center.

Softbank announced the plan to take another chip designer in March, Ampire Computing ,.5.5 $ 6.5 billion??

ChattGPT Maker Opanai is another march investment for Softbank, the Japanese demon has recently said that the investment planned in the company will reach around 8.8 trillion Japanese Yen (.7.7 billion).

Softbank has also invested in many other companies related to AI in his portfolio.

“Softbank’s AI strategy is unanimous, which is a complete AI stack from infrastructure semiconductor, software, infrastructure and robotics, and from severe vertical vertices like enterprise, education, health and autonomous systems,” CNBC said.

“The vision of Mr. Son is to combine these elements together and integrately integrate, to install a powerful AI ecosystem designed to increase the long -term value for our shareholders.”

Softbank’s stock performance from 2017, its first vision fund has been established.

The company is a common theme in the investment of Softbank in AI companies that come directly from the child – that is, these companies should use advanced intelligence to be more competitive, successful, to make their product better and make their customers happy, the company told CNBC. Because of the sensitivity of this case, they can only be unknownly comment.

It started and the brain happened from computers and robots

When Softbank launched “Softbank’s Vision for the next three years” in 2, the boy spoke about the “Brain Computer” during the presentation. They described these computers as a system that can eventually learn and program.

And then the robots came. NVDia Chief Executive Officer Jansen Huang and the like major tech statistics like the like Tesla Boss Elon mask Now AI is talking about robotics as the main application of AI – but the boy was thinking About this more than a decade ago.

In 2, Softbank took the majority of the majority of the French company called Aldarbon. Two years later, both companies started a Humanoid robot called paper, which they are Paid the bill “The first personal robot of the world that can read the feeling.”

Then, the boy Said: “Years in the years I hope robots will become the main business of making a profit for the Softbank group.”

Pepper on Pepper Softbank finally flopped for the company. Softbank Slash made The jobs in his robotics unit and stopped pepper in 2020. In 2022, the German firm United Robotics Group agreed to take Alderan from Softbank.

But the very early interest in the child in the robots underlined the curiosity about the future AI applications.

“He was very early, and he had been thinking of this crazy for a long time,” said Sama, the author of “The Money Trap”.

In the background, the boy was cooking something big: a tech fund that would make waves in the world of investment. He founded the Vision Fund in 2017 With $ 100 billion in deployable capital.

Softbank has aggressively invested in companies around the world and with some of the biggest stalks on ride filtration players Uber And Chinese firm Didi.

But investing in and some in Chinese technology companies Bad stalks on companies like WeWor As the emotion was created for the vision fund Damage to billions of dollars By 2023.

Sight but bad times

The market inquired about some of the child’s investment in companies like Uber and Didi, which was burning by cash at that time and the unit was unclear economics.

But according to a former spouse in the Softbank Vision Fund, the investment also spoke to the child’s AI scene.

“His thought at that time would be AI’s first arrival of AI,” the source told the CNBC.

Again this can be seen in the case of happening too early. Uber created only a driverless car unit to sell it. Instead, the company has focused on other self-driving car companies to bring it to the Uber platform. Even now, driverless cars are not widespread on the road, though there are commercial services like Vemo.

Softbank still has investment in driverless car companies, such as British Startup Wave??

The time was clearly in favor of the child. The child declared softbank after a record loss in Vision Fund in 2022 Will go in the “Defense” modeInvestment significantly reduced and be more prudent. Companies like Openi are starting to get steam at this time, but the company will still keep the company on the map before starting.

“When those companies came to the heads in 2021, 2022, the spice was in a perfect place, but he used all his ammunition on other companies,” said the former Vision Fund Execute.

“When he was age 6, 8, the Vision Fund investing in five or six hundred different companies and he was not in a position to invest in AI and he missed it.”

The boy himself said that Softbank wanted to invest in Open in early 2019, but she was Microsoft He became the main investor. Fast by 2025, Vision Fund – of which there are now – a portfolio is full of AI focus companies.

But this period was difficult for investors in the entire board. Cotton -1 C (a disease disease), prosperity inflation and increased rates of many years of loose monetary policy and after Tech Bull Run, the board was hit in the public and private markets.

Softbank did not look at the time as an opportunity to invest in AA, said a person familiar with the company.

Instead, the company believes that the AI is still very early in the investment cycle, added.

Risk and reward

The AI technology is fast speeding from the chips that underlines the popular applications from the software.

The tech giants in the United States and China have struggled to create AI models for the purpose of reaching artificial general intelligence (AGI)-a nouns with different definitions depending on whom you speak, but there is a great deal of reference to AI. With the investment of billions of dollars in technology, the risk is higher and the rewards can be even higher.

But there is no interruption.

This year, Chinese firm Deepsek made waves after the so -called logic model left Appeared to have developed more cheap than the US rivals?? Despite all export restrictions for advanced technology, the fact that the Chinese company managed this feat, Shakes in the global financial market The United States had an unavailable AIA front.

After the market is survived, there is a major risk for Softbank’s taste due to the potential for surprise in such an early stage of AI.

“Investing in winning technology as most technology is the key to investing in winning technology. Many of Softbank’s investment is among the present leaders, but AI is still in its relative childhood so other challenges can still grow,” said Morningstar’s senior equity analyst Dan Baker.

Still, the child has made it clear that he wants to set a softbank with DNA that will see it To survive and Rich 300 yearsAccording to the company’s website.

This can lead to some of the ways to explain the big risk and specific themes and companies taken by the child and explain the evaluations they are ready to pay.

“He (son) made some mistakes, but by the direction, he is going to the same dryer, which is – he is sure that he is a true player in AI and he is doing it,” said the former Vision Fund Execular.

Post Comment